Online payroll tax calculator

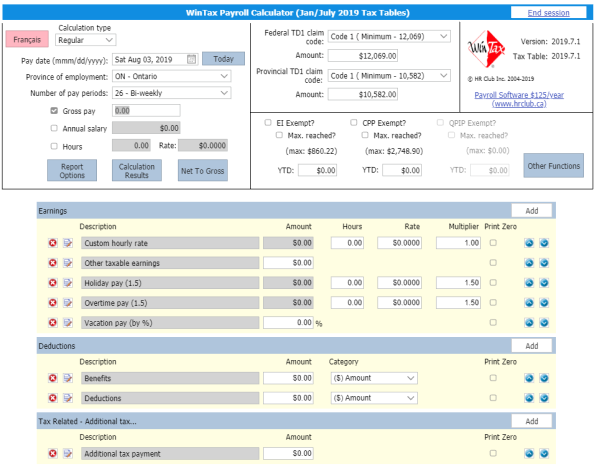

This calculator can assist you with estimating your payroll tax liability. Exempt means the employee does not receive overtime pay.

Your Easy Guide To Payroll Deductions Quickbooks Canada

Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions.

. Federal Salary Paycheck Calculator. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Your liability depends on.

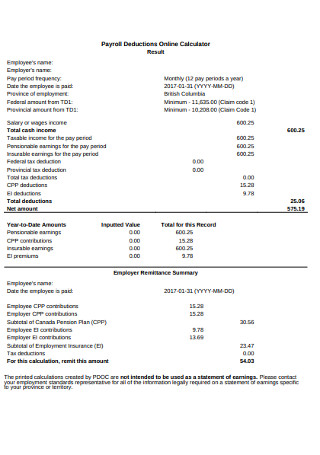

The tool then asks you. Salary commission or pension. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Payroll tax is assessed on the wages paid by an employer in Western Australia. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

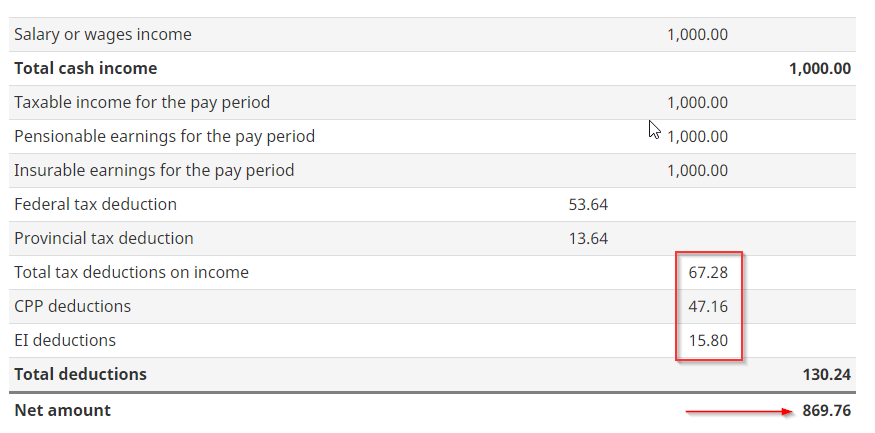

Subtract 12900 for Married otherwise. 2020 Federal income tax withholding calculation. With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start.

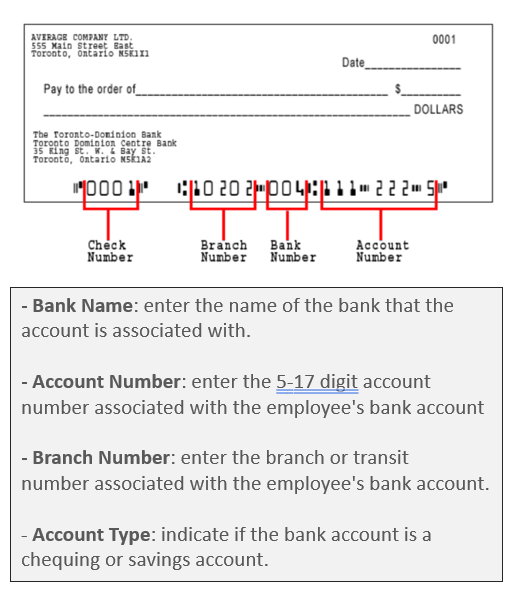

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information. You first need to enter basic information about the type of payments you make.

The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. Calculate your total income taxes. What does eSmart Paychecks FREE Payroll Calculator do.

Free salary hourly and more paycheck calculators. Components of Payroll Tax. How to calculate annual income.

Our updated and free online salary tax calculator. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. It comprises the following components.

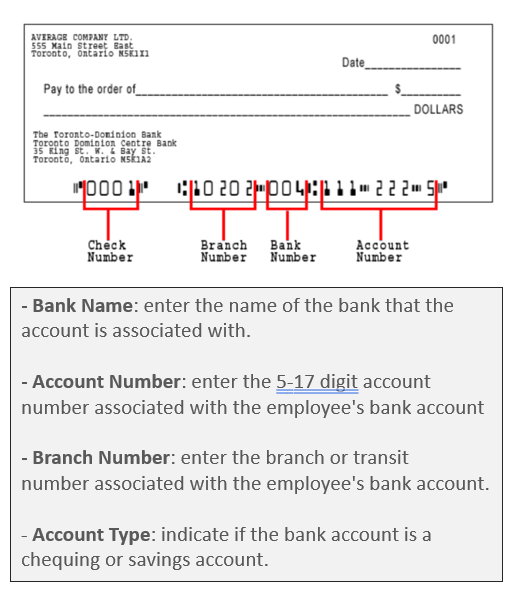

How to use a Payroll Online Deductions Calculator. To try it out enter the. Our online calculator helps you work out your actual monthly tax liability or provides the option to enter an estimate tax liability for the months of July to May.

It will confirm the deductions you include on your. Federal New York taxes FICA and state payroll tax. This component of the Payroll tax is withheld and forms a revenue source for the Federal.

Updated for 2022 tax year. For example if an employee earns. Form TD1-IN Determination of Exemption of an Indians Employment Income.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Thats where our paycheck calculator comes in. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing.

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Wintax Calculator Wintax Canadian Payroll Software

Payroll Tax What It Is How To Calculate It Bench Accounting

21 Sample Payroll Templates Calculators In Pdf Ms Word Excel

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

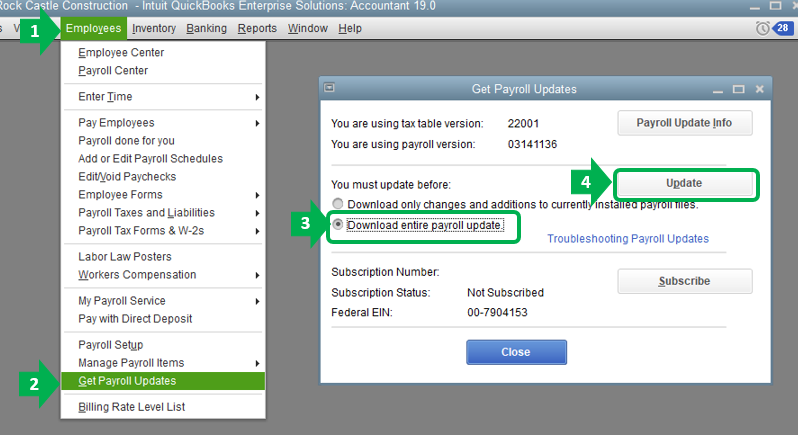

Federal Withholding Not Calculating

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Mathematics For Work And Everyday Life

Everything You Need To Know About Running Payroll In Canada

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Payroll Calculator Free Employee Payroll Template For Excel

How To Enter Payroll Taxes Manually

Payroll Calculator With Pay Stubs For Excel